Invoice discounting is a method of generating cash by retaining selling invoices as collateral with a financial institution in exchange for a service charge paid before the due date. It increases the organization’s working capital.

What exactly is invoice discounting?

Invoice discounting allows a company to get a loan by using its trade receivable as collateral. A specific percentage of trade receivables is loaned. Through invoice discounting, businesses receive advance cash owed from customers, making this a very effective financing solution.

Invoice discounting in banking vs invoice factoring

Factoring and invoice discounting are similar, but there is a key distinction. Because the lender often manages your sales ledger and credit control operations, your clients may be aware that you are receiving money. They will therefore pursue any unpaid balances on your behalf. However, invoice discounting gives you the freedom to continue managing every communication and client relations on your own.

Purpose of invoice discounting

Discounting invoices improves the organization’s cash flow. This fund aids in accelerating future growth. Here, one can discount the sales invoices from the lending institution to satisfy its cash needs rather than waiting for the clients to pay.

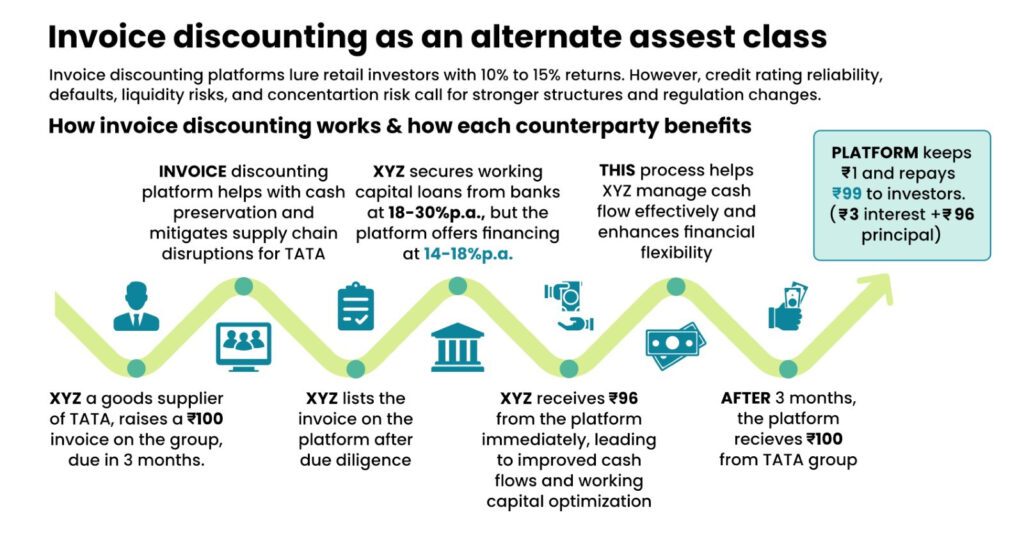

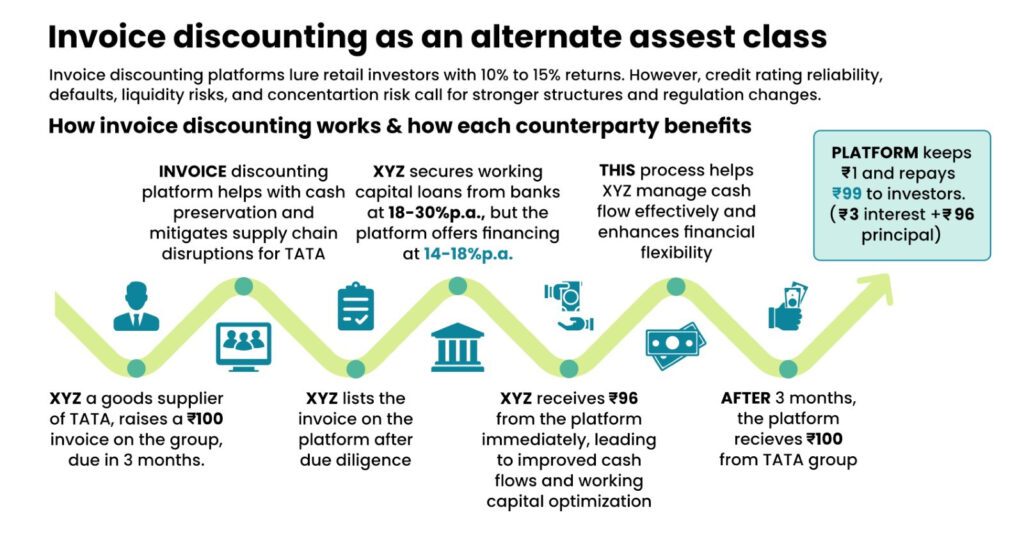

The invoice discounting procedure

- Invoices for items sold to clients are prepared by the organisation.

- These invoices are subsequently forwarded to the lending institution in order to raise financing.

- The lending institution verifies the invoices and issues funds per the agreed-upon terms. The money is distributed as a percentage of the invoice value.

- The invoice amount is collected by the corporate entity or the lending institution in accordance with the terms of the agreement.

- When a customer pays an invoice, the amount received in excess of the funds issued is refunded to the business entity after deducting the service fee.

Souce: livemint.com

How Can Retail Investors Invest In Invoice Discounting?

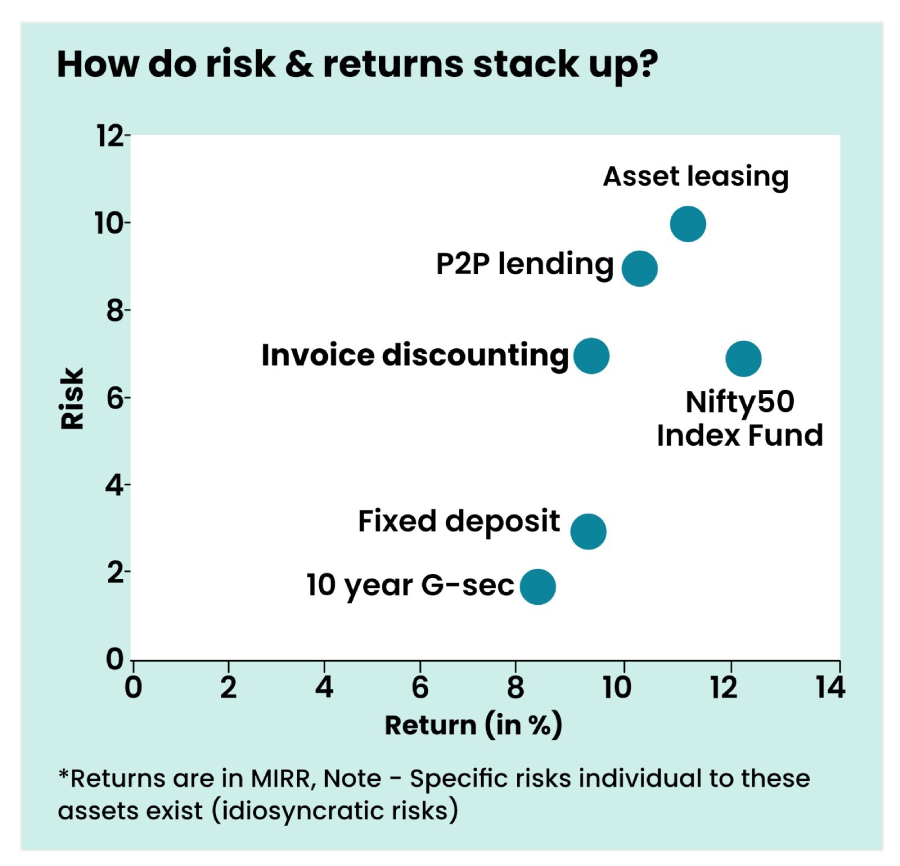

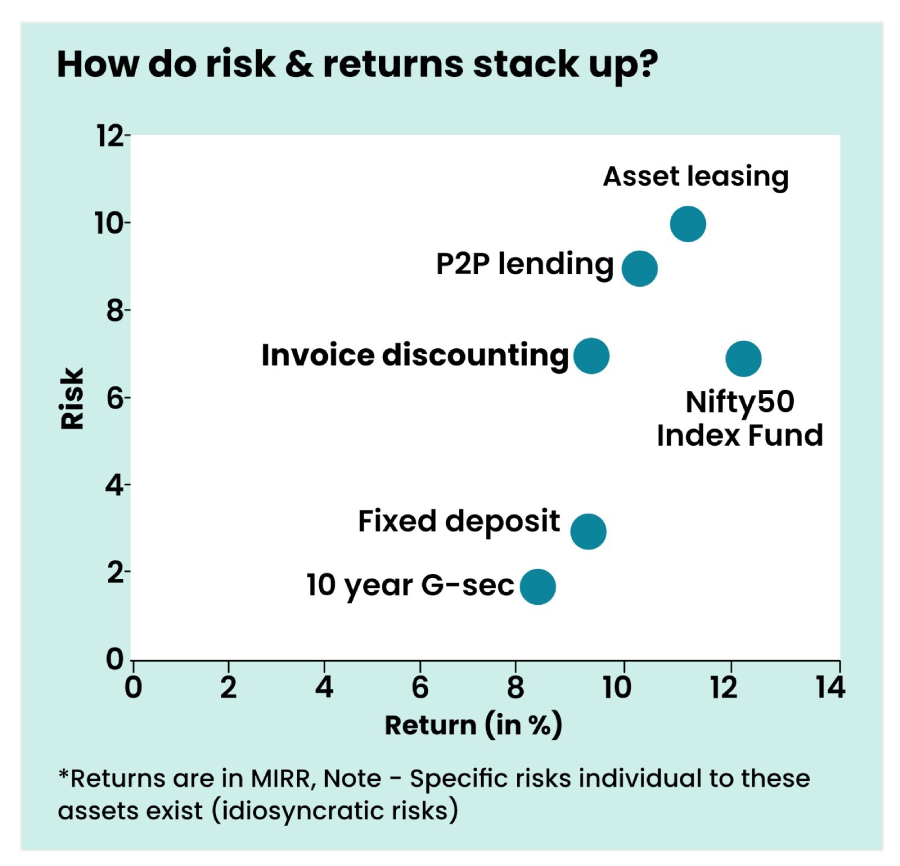

Depending on the risks and other circumstances, there are many platforms like KredX, that have made investments in invoice discounting possible. Each site has a different minimum investment requirement; it may be as low as Rs. 50,000.

Platforms for invoice discounting link reputable businesses and vendors with investors looking for a profit. To obtain working capital, companies use the platform to publish their unpaid invoices. Investors provide these companies with immediate cash and receive a return on their investment within 30 to 90 days.

Anyone can invest, local residents, institutional investors, banks/NBFCs/other financial institutions, HUFs/proprietorships registered in India, and NRIs (as long as they have an NRO account and follow the basic preset KYC requirements, such as having a PAN card and a valid Indian address proof).

Source: livemint.com

Advantage of Invoice Discounting

By effectively speeding up the cash flow from clients, invoice discounting allows you to get paid almost immediately after issuing the invoice rather than waiting for consumers to pay within their typical credit periods. This might be a crucial advantage in cases where a company is critically short on funds.

Disadvantages of Invoice Discounting

Due to the high fees involved, invoice discounting is typically a last-resort financing option. Normally, you wouldn’t utilize it until you had been turned down for the majority of other financing options. Low-margin enterprises should avoid using this method of financing because the debt’s interest may make it impossible for them to turn a profit.

An additional investing option, P2P investment connects lenders and borrowers directly through their marketplace, removing the need for an intermediary. It provides smooth borrowing and lending regardless of location. An individual investor or a financial organization can become a lender on P2P lending platform like Monexo and earn 10% to 13% interest per year, making it a viable investment option.