Dive into the world of P2P lending with our comprehensive guide on investing in India, uncovering strategies, risks, and opportunities for successful financial growth.

Peer to peer lending (P2P lending) is one means of collecting funds for your company. P2P works as an online platform that provides lenders and borrowers with ease of access, flexibility, and lending and borrowing options. The P2P approach pools lenders and borrowers, making it easier to match lenders with borrowers.

Lenders can earn higher interest rates than bank deposits, while borrowers can access cash at lower interest rates than banks.

What is P2P Lending?

Peer-to-peer (P2P) lending is a type of internet lending that allows individuals or businesses to borrow money from other individuals or investors via a platform. It eliminates the need for traditional financial intermediaries such as banks or financial institutions, allowing borrowers and lenders to connect directly. This form of loan is also known as “crowdlending” or “social lending.”

P2P lending, which began in the United Kingdom over 18 years ago, has rapidly grown its global presence and gained widespread acceptance. In recent years, it has grown at a phenomenal annual rate (CAGR) of approximately 30% worldwide, with India growing at an even faster rate.

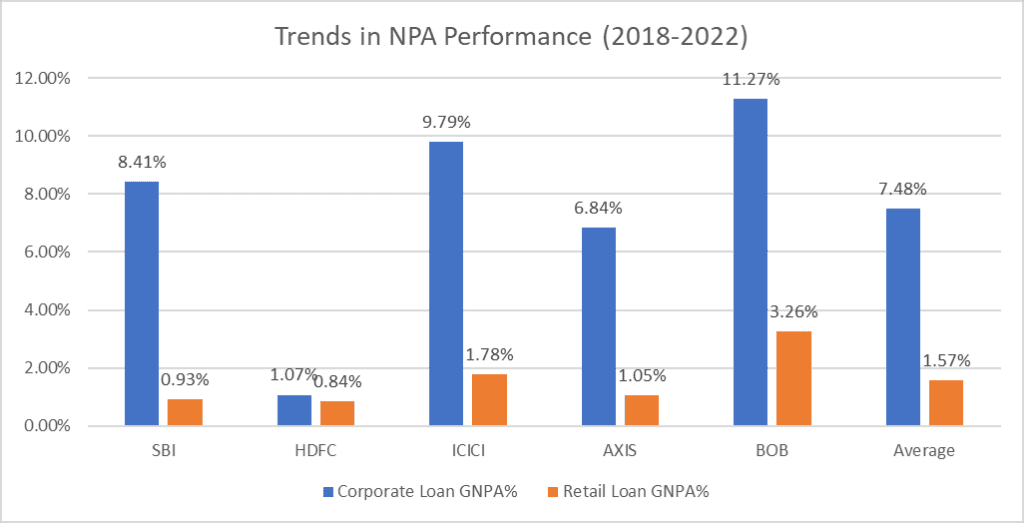

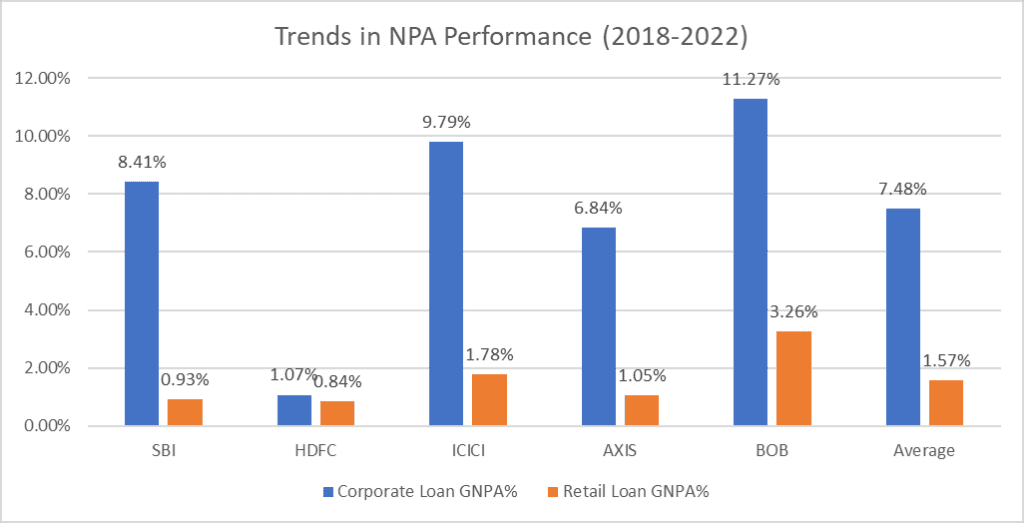

P2P platforms mostly lend money to individual consumers. Retail debt has historically had lower NPAs than corporate loans, both internationally and in India. Retail borrowers have a more direct and personal interest in repaying their debts, which frequently leads to improved repayment behavior. Furthermore, retail borrowers face more strict credit assessments and due diligence, which helps to reduce the risk of default. A graph supporting the following statement is shown below:

Peer-to-Peer (P2P) Lending Mechanism

Here’s a simplified explanation of the peer-to-peer lending method.

- Lender registration: Investors must first register on the site by giving basic personal information as well as KYC information.

- Borrower registration: Borrowers must supply basic KYC information as well as extra information such as credit history, income level, and work status.

- Loan application: Individuals or organisations looking for loans submit applications on the P2P network, including the loan amount, purpose, and other pertinent information.

- Credit assessment: The platform does extensive due diligence on borrowers, including identification, credit history, and financial capacity. They evaluate creditworthiness and assign risk categories to borrowers using multiple data elements and credit evaluation technologies.

- Lender selection: After enrolling on the platform, investors examine borrower profiles and loan requests. Borrowers are chosen depending on their risk tolerance and expected returns.

- Diversification feature: Some systems have an automatic diversification option, which allows investors to spread funds between multiple borrowers, which would otherwise be impossible to do manually.

This decreases NPA risks by keeping exposure to any single borrower to less than 0.5% of the invested amount. Smart algorithms aid in this diversification by allowing even small deposits (like INR 1,000) to be dispersed across multiple borrowers.

- Fund disbursement: After deciding to invest in a borrower’s loan, money are disbursed to the borrower. In rare situations, many lenders can pool their resources to support a single loan.

- Loan Repayment: Borrowers make monthly loan repayments that include both principal and interest. P2P networks make it easier to collect and distribute payments to lenders.

- Default management: In the event of a borrower default, P2P platforms have recovery processes in place to help lenders limit losses. These may include legal action or other forms of recovery.

P2P lending thrives on technology, offering borrowers and investors with efficient and accessible financing alternatives. Understanding this procedure will allow you to make a more informed decision about investing in P2P lending.

Steps to Invest in P2P Lending in India

Since their inception in 2005, internet platforms have significantly aided organized P2P lending. It’s because of the enhanced convenience, paperless approach, and shorter execution time. Any P2P investor must do the following to invest in P2P Lending in India:

- Create an account and register as a lender on a P2P lending network.

- Submit the necessary documentation and get it validated.

- Select their risk tolerance and analyse application proposals

When an investor has found their perfect candidate, they can accept proposals and begin the process. P2P lending, like any other asset class, is fraught with some risks. Before investing in P2P, you should be aware of two major risks:

The possibility of payment defaults: Collections can be difficult. Many P2P platforms assist you in recovering your invested funds from the borrower in accordance with the RBI requirements for NBFC-P2P. However, in some circumstances, retrieving the cash may necessitate a great deal more effort.

Lower returns: If your borrower repays the loans earlier than intended, you may wind up with less profit than expected.

However, there are numerous ways to eliminate these risks, and you must take all necessary precautions.

What is the lending and borrowing limits?

The loan amount might range between Rs 500 and Rs 750. The aggregate maximum amount per lender across all P2P sites is Rs 50,00,000. If a lender lends more than Rs 10,00,000, a certificate from a licensed Chartered Accountant is required, certifying a minimum net worth of Rs 50,00,000.

A single lender’s loan to a single borrower should not exceed Rs 50,000 in one-on-one lending. P2Ps should get a certificate from the borrower or lender certifying that the borrowing and lending limitations have been met.

Is P2P lending legal in India?

According to RBI regulations, such lending in India must be facilitated via an NBFC-P2P platform that has obtained the relevant RBI approvals. Both the lender, or investor, and the borrower are retail customers, with the lender limited to a maximum loan amount of Rs 50 lakh on such platforms. Monexo.co is one of the best RBI approved P2P investment platforms in India where you can invest your money to get high returns at low risk.

Conclusion

Before making any investments, investors should educate themselves about the instrument. There are advantages and disadvantages of P2P platforms which needs to be analyzed. Going over the platform standards will provide you a thorough idea of what you can do if you require assistance. Furthermore, a solid understanding of the P2P ecosystem and your investment plan can help you become a successful P2P investor.