Rising prices for everything we need and want are a harsh reality for most of us. We witness price increases every few months, and after a few minutes of grumbling about the rising ‘mehenghai’, we accept it and move on.

Inflation is the term used to explain this rise.

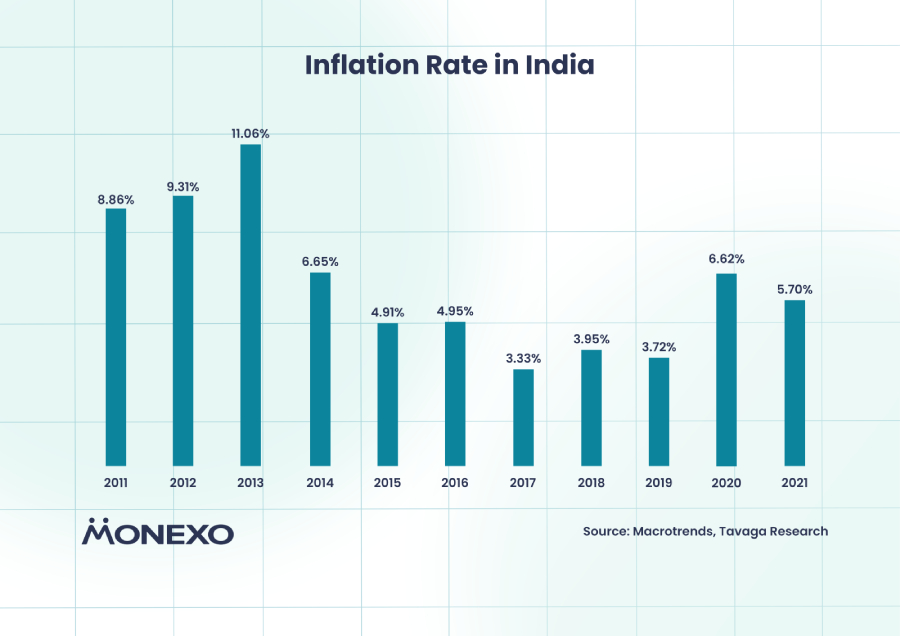

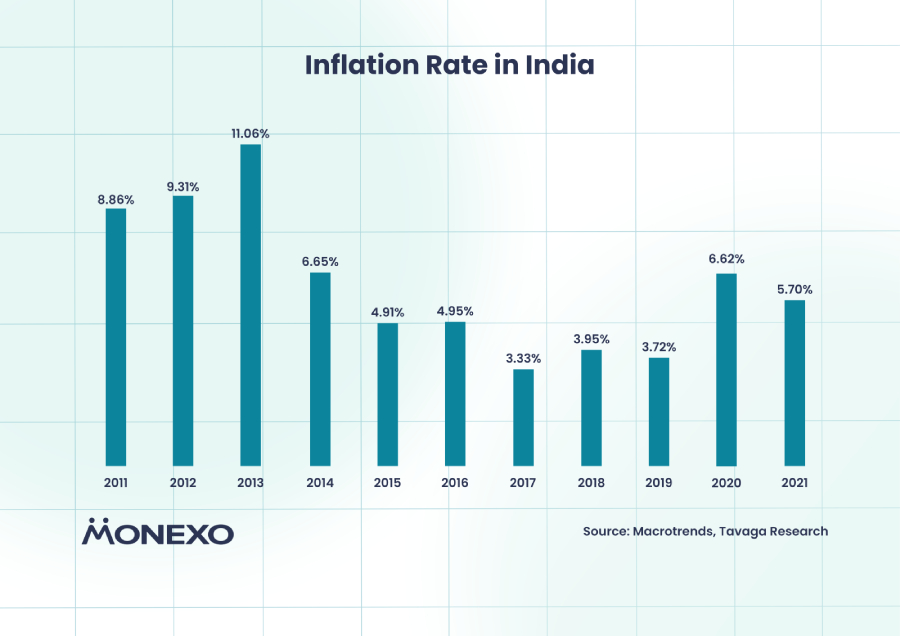

Inflation diminishes one’s purchasing power, or ability to buy goods and services. Rising inflation raises the expense of living, while the rate of return on investment does not. In March 2022, retail inflation in India reached 6.95%, the highest level since October 2020.

What Does ‘Fighting Inflation’ Mean?

Fighting inflation implies earning higher returns on investment than the economy’s inflation rate. To combat the effects of inflation, it is essential to strive for investment returns that surpass the overall inflation rate. It’s crucial to earn a level of return that outpaces the rising prices of goods and services. Otherwise, your investment gains would essentially be rendered ineffective in combating inflation.

Imagine if you invested Rs 1,000 in an opportunity that promised a 4% return the following year. Your investment would have grown to Rs 1,040. However, it’s important to note that the economy’s inflation rate is at a high of 5.5%. As a result, your real return on investment is actually less than the inflation rate. In other words, the returns you earned are effectively negated by rising prices and the impact of inflation.

It’s no surprise that the purchasing power of money diminishes each year due to various factors. This leads to an increase in prices for goods and services, which is commonly known as inflation. Understanding this economic phenomenon is crucial for individuals and businesses alike to make informed financial decisions.

Best Ways to Beat Inflation in India

Many people believe that saving alone is enough to meet their financial needs. However, it often falls short. Investing, on the other hand, offers a way to not only grow your savings but also turn them into valuable assets that appreciate over time. Of course, successful investing requires careful execution and informed decisions.

Choosing the right investment tools is crucial to ensure the growth of your money. It’s important to note that if you opt for tools with interest rates lower than the inflation rate, your investment may struggle to keep up with rising prices. To stay ahead in the race against inflation and protect the value of your investment, it’s advisable to consider options that offer higher returns than inflation. On the other hand, by choosing the right investment instruments, you can not only keep pace with inflation but also have surplus funds after paying your bills.

Let’s delve into some of the investment options available in India and assess their historical performance against inflation.

1. Equity-Oriented Investments

Stock markets have outperformed inflation in the long run. However, there are numerous ups and downs and volatile situations in the near term. Take the years 2020 and 2021 as an example. From over 40,000 in January 2020, the Sensex reached 25,000 in March 2020. The Sensex will have reached 60,000 points by 2023.

As of April 15, 2021, the Sensex had returned over 88% CAGR in 5 years. Individual stock performance can be different from benchmark index performance.

It demonstrates that, in the long run, stock markets recover. Risks and losses balance out. Stock market investments that are goal-oriented and well-researched can help you overcome inflation.

2. Peer to Peer investing

Peer-to-peer investing allows individuals to directly invest in loans provided to borrowers, eliminating the need for traditional financial institutions. This innovative approach offers investors an opportunity to earn attractive returns of up to 13% on their investments.

By cutting out intermediaries, peer-to-peer investing provides a win-win situation for both lenders and borrowers. Investors can enjoy higher interest rates compared to traditional savings accounts or fixed deposits, while borrowers can access funds at competitive rates.

Moreover, peer-to-peer investing offers flexibility in terms of investment amounts and tenures. Inflation can eat into the purchasing power of your income, peer-to-peer investing provides a viable solution for growing and protecting your wealth.

3. Gold Exchange Traded Funds (Gold ETFs)

Gold is not a financial asset; it is a commodity. According to a World Gold Council study, every 1% increase in inflation corresponds to a 2.6% increase in gold demand, which leads to an increase in price.

Gold ETFs are open-ended mutual fund schemes that give investors exposure to the gold market and are based on the price of gold, which fluctuates. Physical gold does not create income, and the making charges are exorbitant. For investors looking to outpace inflation over the long term, gold ETFs are an outstanding long-term investment alternative.

4. Real Estate

According to many media reports and analyses produced by real estate organizations in India, the returns on real estate investments have averaged approximately 9% over the past ten years. However, investing in real estate necessitates a significant initial outlay, typically in the lakhs or crores.

According to the RBI’s House Price Index, which tracks real estate prices in ten cities, the average return on Indian real estate ownership over the last ten years has been roughly 9% as of 2023. However, returns may fluctuate from city to city because property prices vary greatly by region.

The returns may have outperformed inflation. However, there are some factors to keep in mind when it comes buying real estate.

For starters, the cost of investing in real estate can be enormous, and most of us will need to take out a loan to do so. As a result, the returns should cover the interest on the loan as well as any extra expenditures invested in acquiring the property in the first place.

5. Debt-Oriented Investments

Investing in bonds or debt funds that have a close connection to interest rates in the economy is a wise move. As interest rates fluctuate, so do the returns on these investments. This relationship is intertwined with inflation rates, making it essential for investors to consider both factors when making their financial decisions. By understanding this close link, you can better navigate the market and make informed choices that align with your investment goals.

In times of inflation, it’s important to consider the impact it has on interest rates. As inflation rises, interest rates typically follow suit, meaning they will increase. This relationship between inflation and interest rates also affects bond prices in an interesting way. When interest rates go up, bond prices tend to go down as they move in opposite directions. Therefore, if inflation rises and correspondingly pushes up interest rates, we can expect bond prices to fall as a result. This is an important consideration for investors who hold bond funds, as they may experience a loss in value during periods of inflationary environments. Diversification plays a crucial role in managing returns, protecting against inflation, and preserving capital. It is an essential strategy that allows you to mitigate risks and maximize your investment potential. By spreading your investments across different assets or markets, you can safeguard your portfolio and achieve long-term financial stability.

6. Rebalance Your Portfolio

Portfolio rebalancing is an essential practice to optimize the performance of your investments in response to evolving market conditions. Factors such as fluctuating inflation rates, shifting financial objectives, and various other variables can make it necessary to realign your assets. By rebalancing, you ensure that your portfolio remains aligned with your long-term goals and maximizes potential returns. It’s worth considering that a portfolio designed in 2012 with specific economic and inflation factors may not be as effective in today’s market. To safeguard your investments against inflation, it’s crucial to review and update your portfolio regularly, making necessary adjustments when warranted. This proactive approach ensures that your portfolio remains resilient and capable of tackling the challenges posed by changing economic conditions.

Bottom Line

By not making investments, you’re essentially letting inflation erode the value of your hard-earned money. The longer you delay, the more your money loses its worth with each passing minute. It’s time to act and safeguard your financial future by putting your money to work through investing. Investing in products like peer-to-peer lending is essential if you want to stay ahead of inflation and ensure your money grows. With the potential to beat inflation by a significant margin, these innovative investment options offer a lucrative opportunity for individuals who are looking to maximize their returns.