With the Indian economy expanding at such a rapid pace, it is no surprise that the personal finance sector is thriving.

The Indian economy, which is still in its early stages, frequently provides a platform for the introduction of new and innovative avenues in the finance sector. We have seen exponential growth in the last few years since the commerce space was met with digitalization. As a result, it provided the means to investigate new-age and advanced methods of managing one’s personal finances.

There are some exciting personal finance trends to look out for in India in 2023. Let’s take a look at the top personal finance trends that can help you improve your investment portfolio by providing hassle-free wealth management options.

Buy Now Pay Later (BNPL)

India’s formal economy is experiencing a new trend of Buy Now, Pay Later (BNPL). You’re probably a regular at some local shop or grocery store where you don’t have to pay for every little purchase all the time. Rather, you most likely have a bill with the vendor that you pay at the end of each month or after a certain period. That is the fundamental premise of Buy Now, Pay Later. It is a payment method that is gaining popularity as it allows you to buy goods and services without having to pay for them right away.

Instead, you pay off your debts or credit card balance at a later date determined by your lender. BNPL is an excellent way to manage your day-to-day finances without breaking the bank. In India, BNPL usage is expected to rise rapidly, at least in the short term. However, it has the potential to be a game changer across the country in the coming years.

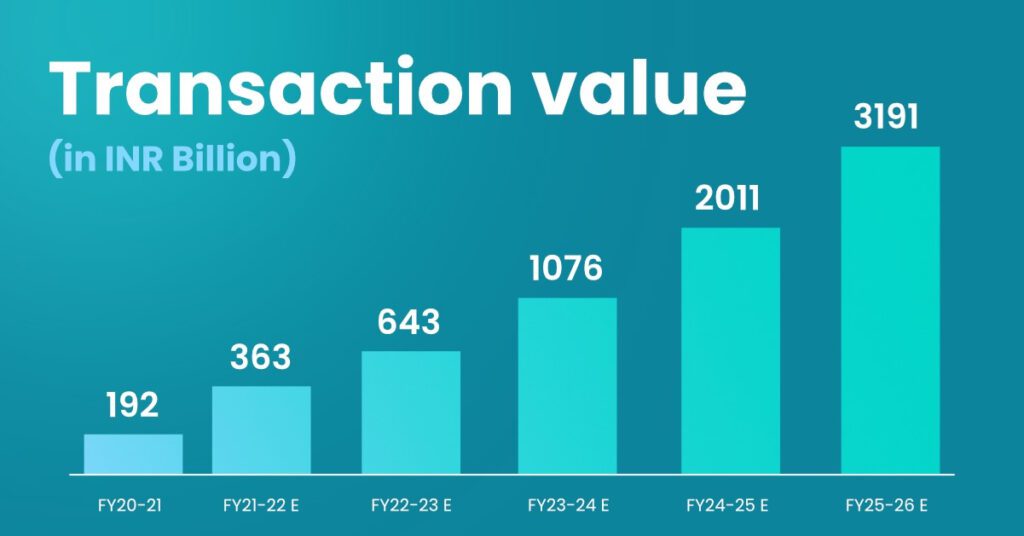

BNPL payment adoption is predicted to increase steadily in the coming years, with a CAGR of 12.2% between 2023 and 2028. The country’s BNPL Gross Merchandise Value would rise from US$11,628.8 million in 2022 to US$25,387.2 million by 2028.

Source: PwC Analysis

The buy now pay later space has grown significantly amid the growing traction for flexible payment methods among consumers in Tier II and Tier III cities of India.

Cryptocurrency

A cryptocurrency is a digital form of money that uses cryptography to ensure its security and can be used to make payments or store value.

One of the world’s most discussed and debated financial products. Because of the craze surrounding cryptocurrencies such as Bitcoin, Dogecoin, Solana, and others, central banks around the world are debating how and what to do with this ongoing phenomenon.

The cryptocurrency frenzy has proven to be generating and depleting ‘nuts!’ amount of wealth, with a drop or rise of even 100% in a single day being’ more than’ possible.

One of the riskiest asset classes to include in your investment portfolio, but it is becoming increasingly popular, particularly among millennials.

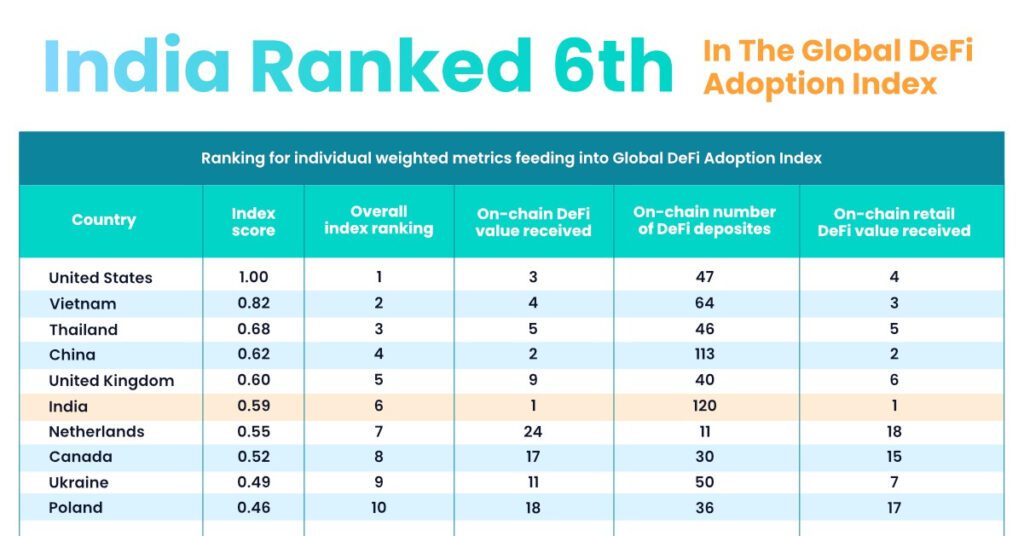

The Indian cryptocurrency market has grown rapidly in recent years and is predicted to reach $241 million by 2030 in India and $2.3 billion globally by 2026. 45% of crypto investors in India are aged between 18-25 and 34% are in the 26-35 age range as per a 2022 survey.As per research, India’s total crypto user base was estimated to be around 115 million.

However, given the recent events and advent of CBDC as well as taxation – this product has lost its shine.

Souce: Chainanalysis Inc40

ETFs: In simple words ‘tradable mutual funds’

Exchange traded funds (ETFs) are a type of investment fund similar to a mutual fund in that its units can be traded on the open market just like stocks.

In comparison to November 20, this personal finance tool increased by 58% in November 21.

Many ETFs on the market are the same as index-based mutual funds. ETFs have a lower expense ratio than even direct index mutual funds, giving them an advantage over mutual funds when investing in a lump sum.

According to Mirae, the worldwide AUM of the ETF market increased to $82 billion in 2022 from $75 billion in 2021. Furthermore, its analysis revealed that most ETF-tracking benchmark indexes performed best in the last three years, showing that Indian ETFs had improved their performance.

However, many Indian ETFs have had negative growth in the recent year. In the last year, however, numerous foreign stock exchanges beat their Indian equivalents.

Peer-To-Peer (P2P) Lending:

Traditionally, we deposit money in banks and earn fixed-rate interest. The simple mechanism is that banks accept deposits and lend them to borrowers at a higher interest rate than they do to account holders.

If you eliminate the intermediary and carry out the lending and borrowing transactions directly, you will earn significantly more interest than your bank has been offering. P2P lending provides a platform for individuals seeking to borrow and lend money to conduct direct credit transactions. P2P lending platforms like Monexo, allow investors to earn up to 2x of Fixed deposits.

P2P lending requires a license and you should only deal with licensed companies.

This modern investment strategy is appropriate for investors with a medium to high risk tolerance and a diverse investment portfolio. It is a boon for those who find it difficult to obtain formal credit as well as those who want to earn more money despite the risk.

With the constant advancement of the fintech industry, P2P lending may undergo more changes in the near future that will elevate it to reliable source of investment alternative, making it worth keeping an eye on.

Neobanking

Yes, banks have already entered the digital sphere and brought their financial services to our fingertips, but is it possible to have 100% virtual banking? That is the fundamental premise of Neobanks, which are non-physical banks that operate entirely on the internet. As a result, these are also referred to as digital banks. They offer a similar range of financial products and services as traditional banks. Debit cards, loans, online payments, investments, money transfers, withdrawals, deposits, and so on are examples.

On the downside, Neobanks are not authorised to conduct independent operations because the RBI has not yet issued a banking license to such digital entities. As a result, they, like NBFCs, work in collaboration with traditionally licensed banks. The benefit of Neobanks is that they have low operating costs as a result of a comprehensive online process. They are thus able to create, verify, update, and transact accounts faster.

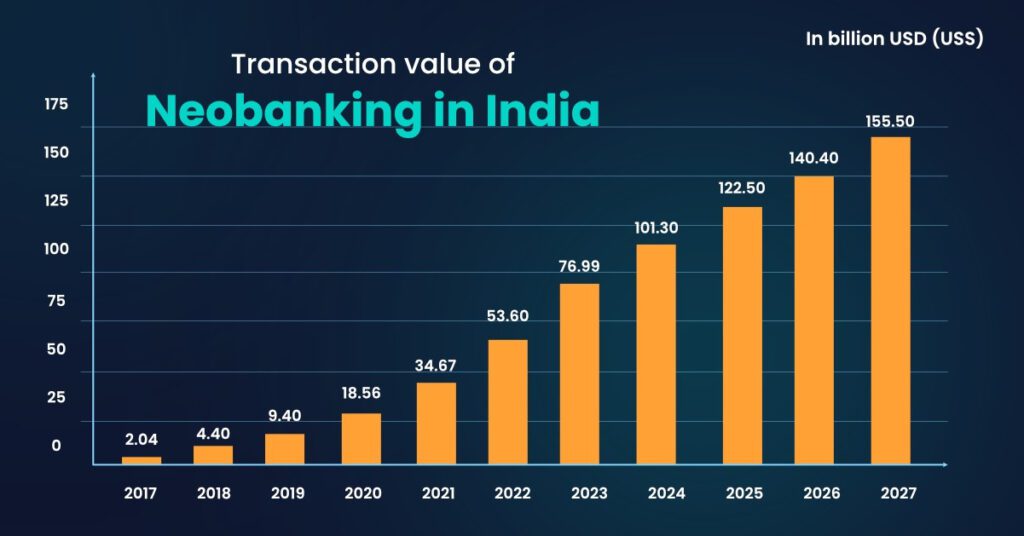

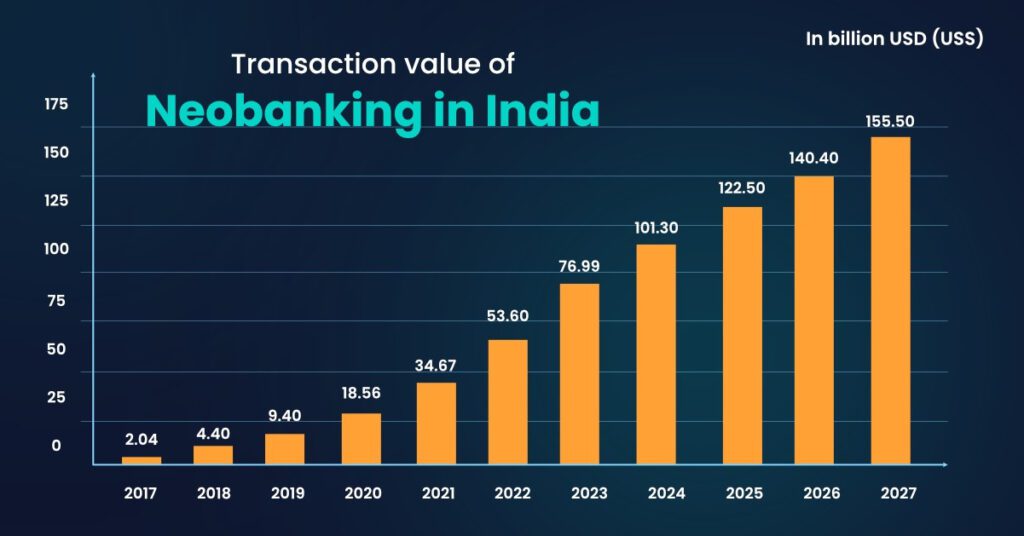

Transaction value globally is estimated to grow at a 19.21% annual rate (CAGR 2023-2027), resulting in a total sum of US$155.50 billion by 2027.

In 2023, the average transaction value per user in the Neobanking market is $6.20k USD.

Source: Statista.com

Conclusion:

These are some of the most recent personal finance management trends that are gaining popularity and have the potential to grow in the coming years. As we enter the new financial era, make sure to research and comprehend these progressive methods in order to reap the benefits of any scheme that most appeals to you. If you are still unsure, you can always consult a finance expert for more information and personalized recommendations.